Evaluating Gold IRA Company Ratings: A Complete Guide to Present Trend…

본문

Lately, the funding panorama has seen a significant shift, with many buyers turning their attention to alternative belongings, particularly gold. Because of this, Gold Individual Retirement Accounts (IRAs) have gained reputation as a means of diversifying retirement portfolios and safeguarding wealth against inflation and financial uncertainty. This surge in curiosity has led to a rise within the variety of corporations offering Gold IRA services, making it important for buyers to grasp how to judge these corporations successfully. This text explores the current developments in Gold IRA company ratings and provides insights into what investors should consider when deciding on a provider.

Understanding Gold IRAs

Earlier than delving into firm scores, it's crucial to grasp what a Gold IRA is. A Gold IRA is a self-directed retirement account that permits investors to carry bodily gold, as well as different treasured metals, as part of their retirement portfolio. Such a account supplies the identical tax advantages as traditional IRAs while providing a hedge against inflation and forex fluctuations. Nevertheless, investing in a Gold IRA requires cautious consideration of assorted factors, together with the reputation and reliability of the company managing the account.

The Significance of Firm Rankings

Company ratings serve as a valuable useful resource for buyers wanting to choose a Gold IRA provider. These scores are usually based mostly on a combination of things, including customer evaluations, industry status, regulatory compliance, charges, and the vary of companies offered. Excessive ratings can point out a reliable and reliable firm, while decrease scores might sign potential issues or issues that buyers should bear in mind of.

Current Developments in Gold IRA Company Ratings

- Elevated Transparency: One of the most notable trends in Gold IRA company ratings is the rising emphasis on transparency. Buyers are increasingly searching for companies that present clear information about their charges, companies, and investment options. Companies that are open about their practices and provide detailed disclosures are inclined to obtain increased scores from clients and industry analysts alike.

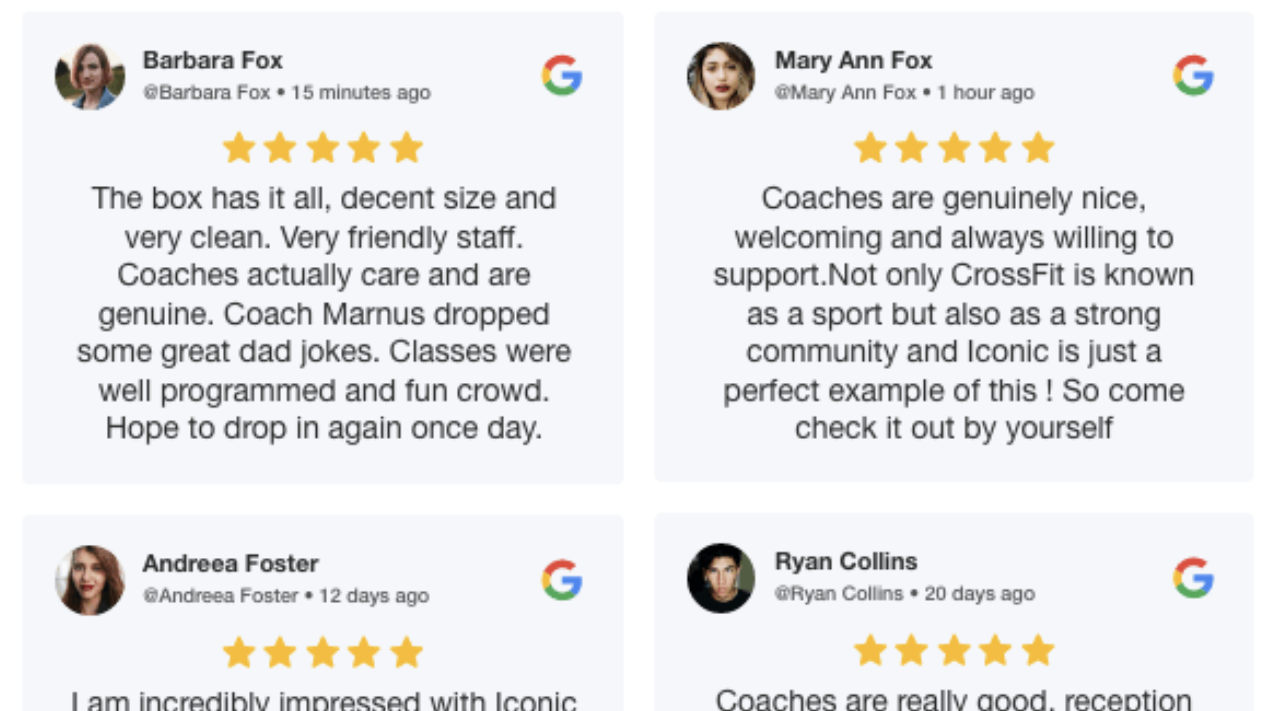

- Buyer Opinions and Suggestions: Online reviews have turn into a critical component of company scores. Buyers typically flip to platforms like Trustpilot, Higher Enterprise Bureau (BBB), and Google Critiques to gauge the experiences of other prospects. Corporations that constantly obtain positive feedback concerning their customer service, responsiveness, and general satisfaction tend to rank greater. Conversely, negative opinions can significantly influence a company's score and fame.

- Regulatory Compliance: As the Gold IRA market continues to develop, regulatory bodies are paying closer consideration to the practices of those firms. Buyers are inspired to decide on suppliers that adhere to trade rules and maintain a good standing with the IRS. Corporations that show compliance and ethical practices typically receive increased scores, as they're seen as more trustworthy and dependable.

- Educational Resources: Companies that offer instructional sources and steerage to investors are also gaining increased rankings. Offering details about the advantages and risks of investing in gold, as well as insights into market developments, Gold IRA company ratings helps construct belief with potential shoppers. Buyers recognize firms that empower them with knowledge, permitting them to make informed choices.

- Diverse Investment Choices: The range of investment choices obtainable by means of Gold IRA suppliers is one other essential issue influencing rankings. Corporations that supply a variety of valuable metals, including gold, silver, platinum, and palladium, tend to draw more buyers. Moreover, those who present options for several types of gold, reminiscent of bullion, coins, and bars, obtain favorable scores for their flexibility.

Evaluating Gold IRA Companies: Key Issues

When assessing Gold IRA companies and their ratings, buyers ought to consider the following key factors:

- Charges and Costs: Understanding the charge structure is essential. Look for corporations that provide a transparent breakdown of their fees, together with setup fees, storage fees, and management charges. Excessive fees can erode investment returns, so it is essential to match prices amongst totally different suppliers.

- Customer support: Glorious customer service can considerably enhance the investment expertise. Investors ought to look for corporations that provide responsive support, whether by means of phone, gold ira company ratings e mail, or reside chat. Optimistic customer support experiences typically correlate with greater rankings.

- Storage Options: The safety of treasured metals is paramount. Investors ought to inquire concerning the storage choices accessible, including whether the metals will probably be saved in a safe, IRS-authorised facility. Companies that supply segregated storage and insurance coverage protection for the metals are likely to receive favorable rankings.

- Status and Expertise: Researching the corporate's historical past and gold ira company ratings status within the industry is crucial. Companies with a long monitor document of successful operations and optimistic customer suggestions are typically extra reliable. Look for any awards or recognitions that will indicate trade credibility.

- Instructional Assist: As mentioned earlier, companies that provide instructional assets can improve their rankings. Investors should consider whether the corporate provides webinars, articles, or one-on-one consultations to help them navigate the Gold IRA landscape.

Conclusion

Because the demand for Gold IRAs continues to rise, understanding how to evaluate Gold IRA company ratings is essential for making informed funding decisions. The current trends spotlight the significance of transparency, customer feedback, regulatory compliance, and instructional assets in shaping firm scores. By contemplating key factors akin to charges, customer support, storage choices, status, and educational assist, traders can determine respected Gold IRA providers that align with their funding targets.

In this evolving market, staying informed about the most recent developments and insights in Gold IRA company ratings will empower buyers to make sound choices that can positively influence their financial futures. Whether or not you're a seasoned investor or new to the world of Gold IRAs, leveraging company scores as a software for Gold IRA company ratings analysis can result in a extra successful and secure retirement funding technique.

댓글목록0

댓글 포인트 안내